- Written by Stuart Green - Account Director Contact Centre

- Connect with Stuart on LinkedIn

When digging into the benefits of conversational IVR for financial services companies, it boils down to the same metrics you use to measure your business. You don’t care if it’s got bells and whistles. You care whether you’re going to save customers time, improve agent efficiency, and improve the customer experience. It does! Let’s explore further what conversational IVR is and how your finance business can benefit.

What is Conversational IVR?

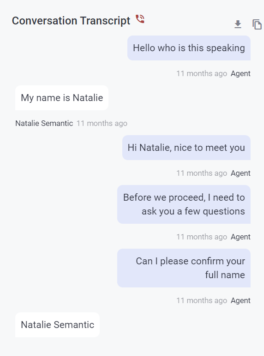

Conversational IVR enables two-way communication between customers who reach you via phone or live chat. When they dial your number, customers are greeted with standard numeric options or can choose to say what their query is about. From here, a conversational IVR starts to engage with a caller instead of simply directing their call.

You can ask questions to pass identity and verification, troubleshoot basic functionality, or recall past documentation. For example, if an existing customer received a quote online and is calling to renew their policy, they can do this without the need for human intervention.

Your IVR can recall the quote number, walk the customer through terms and conditions, with the customer responding with approval yes’ or no’s and key presses to confirm they would like to go ahead.

Likewise, in the case of a chatbot, it’s taking the form of a conversation rather than responding to specific inputs. Whereas you might expect a chatbot to give you a list of options then look for the relevant agent, it’s now going to provide responses based on previous interactions and appropriate suggestions within its AI learning model.

Note: You can still present options for traditional routing. In almost all cases, we advocate having at least one option where you can choose to talk to a human.

In some cases, especially financial services, just because you’re on board with self-service, it doesn’t mean every single customer is.

However, studies show that as newer generations enter the workplace, self service is one of the most expected communication methods within any contact centre.

In her article titled “Traditional banks are adapting because they must”, Hailey Shutkowski reveals that;

52% of millennials said they would switch banks for better mobile or digital capabilities.

How to set up Conversational IVR

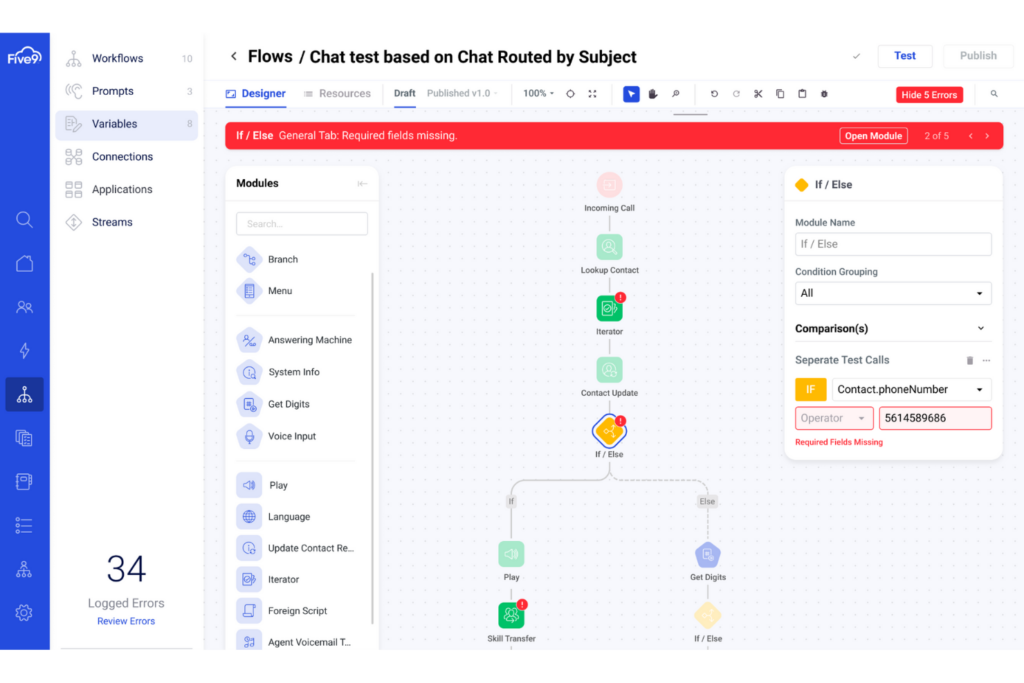

You can pre-configure “if this then that” (IFTTT) queries, answers, and routing. But you can also take advantage of the machine learning and natural language understanding tools within conversational IVR technology.

So, instead of only recognising the inputs you configure and being limited to the types of questions your IVR can answer, you utilise the language learning models of artificial intelligence.

You can also integrate your IVR with other line of business systems to do cross-system data dips and recall information like invoices, recent transactions, and contract renewal dates.

The end result?

A customer calls you to query their invoice, your IVR asks them for their account details, verifies it cross-system, and suggests the reason why the amount is more than they were expecting. It could be common scenarios like when a mortgage payment is taken the second month with the first month in arrears tacked on. Or it could be a clerical error that is spotted immediately by AI.

Whatever the issue, your IVR can either trace it and remedy it or find the most suitable agent to deal with your customer’s query.

Download our guide exploring AI driven contact centres for FinServ businesses

Discover the current industry views on AI within FinServ, the use cases for AI and take a look at which companies are successfully using it and how AI is delivering value.

Add Your Heading Text Here

Benefits of Conversational IVR

Reduced wait times

With self service automation handling routine enquiries and even some more complex issues, expect your average wait time (and average handle time) to come crashing down. There’s no need for a caller or someone on your website to wait for an initial answer as AI doesn’t take breaks and can handle multiple queries at a time.

When customers do need to speed to a human agent, the hold times are significantly reduced as they’re not all busy with mundane queries like opening times and account balances.

Fewer agent transfers

When customers report issues via conversational IVR, there are two possible outcomes:

- It works on your issue without the need for a human.

- It transfers you to the most qualified, available agent.

In conjunction with skills-based routing and or automatic call distribution, your IVR routes calls to the right place every time. There’s no misdialing, transferring to the wrong person, or accidental hang ups. What’s more, customers get through to specialists who can help without the need for assistance or repetition of the query.

Higher first call resolution

Longer customer retention

When customers get answers to their queries in a timely manner, and without needing to call back multiple times, they’re going to stay with you longer. Even when there’s an issue with a product, a memorable customer experience, goes a long way when renewal time comes around.

Customers who accept that problems occur now and again are more likely to remain with you versus the time, evaluation, and hassle associated with moving providers if your customer experience is high quality.

Higher chance of referral

With more loyal customers comes a higher chance of referral customers. This happens in our personal lives as well as business. Put simply, if we have a nice time, we tell people about it. This applies to hotels and restaurants but it also applies to car insurance and banking. With a market of extremely similar products, price and customer experience repeatedly come out on top as contributing factors for renewal and referral.

In contrast, 32% of consumers say they’d switch brands after just one bad telephone experience. While “bad” experiences also include poor customer service, the majority stem from long wait times and the repeating of information to multiple agents.

When you remove the need to wait, the potential for a bad experience plummets. And if you type or say your query to a bot, they don’t need you to repeat it as everything is transcribed.

Why Conversational IVR is right for financial services companies now

It’s long been thought that finance companies (and adjacent industries like insurance and legal) are extremely risk averse. It’s the nature of the industry. You’re dealing with personal, financial, and company information all day long. Some of the figures you’re managing are in the thousands, millions, and even billions.

It’s deemed far easier not to upset the apple cart instead of adapting and implementing new cloud technology. Well, now the time has come when it’s easy for companies like these (and like First Central, our client who is one of the biggest motor insurance providers in the UK) to start benefiting from conversational IVR without the need for adaptation or complex deployment.

If a 900 user insurance company can use AI, so can you

First Central has 900 staff and receives 3.75 million minutes of phone calls inbound every month. Its previous legacy phone system couldn’t cope with demand and agents couldn’t handle calls the way their customers demanded.

Now, armed with an AI-powered omnichannel contact centre solution, they have a central hub which:

- Keeps customers coming back

- Demonstrates innovation to customers and employees

- Is flexible in terms of number of staff

- Reports on human and AI interactions

- Has a simplified call routing plan

- Remove unnecessary agent admin tasks

There’s no need for intrusive bots or third party apps that need all sorts of permissions and access. There’s no need for building workarounds so payment information gets hidden. Instead, conversational IVR, albeit still a remarkable technology, is now simply another feature of your cloud contact centre. You’ve just got to turn it on.

When 61% of banking executives are planning to increase investments in AI within the next 12 months, don’t be the last one to start delighting your customers with self service.

It’s time to take action.