THOUGHT LEADERSHIP GUIDE WITH FIVE9

HOW TO IMPROVE CX IN FINSERVE CONTACT CENTRES

Methods and technology focussed on how to improve CX in financial services

In this guide jointly produced by Opus and Five9, we explore some of the challenges facing financial services organisations and their ability to improve CX. Increasing competition, rocketing customer expectations and complexity in managing ever-increasing communication channels can all have a negative impact on customer loyalty and retention.

To address these challenges, Five9 provides innovative contact centre solutions that remove silos and eliminate bottlenecks, supporting the transformation of customer interactions.

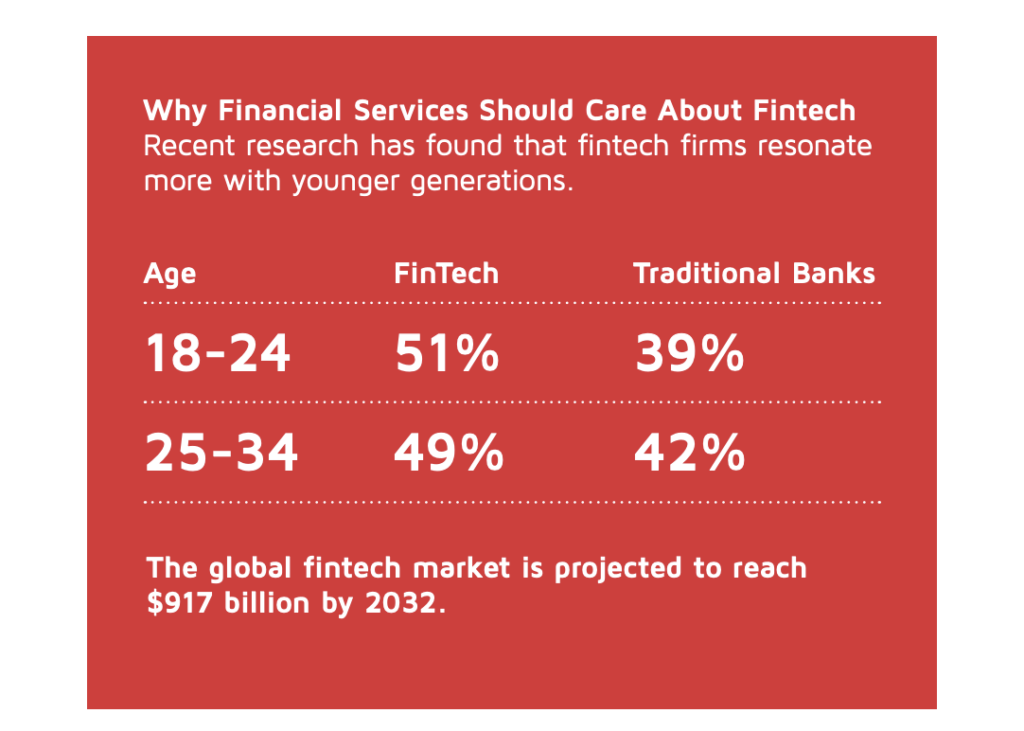

Established financial services institutions, including banks, lenders, insurance firms and wealth management organisations, are facing a new wave of agile competitors: fintechs. These competitors benefit from low overheads and the latest scalable, adaptable technologies. To avoid losing market share, it’s crucial for traditional institutions to keep pace with the competition.

To succeed in this new environment, financial services need to cultivate a more connected, personalised and insightful relationship with their customers.

Businesses must shift from a focus on customer service towards the overall customer experience. Upgrading the customer experience as it passes through your contact centres is an essential part of the digital transformation needed to meet the demands of today’s customers.

To achieve this and get on the right side of these seismic market shifts in user expectations and competitive dynamics, the organisation needs to question a number of fundamental technologies and philosophies in the contact centre. These centre on a collection of market forces covered off below.

Four challenges facing financial services when trying to improve CX

In order to provide services that new and existing customers demand, traditional financial services providers must overcome a number of barriers that currently prevent them from delivering cutting-edge customer experiences.

1. Inflexible on-premises systems

- Many financial services organisations still rely on stable, but inflexible on-premises systems. While this ensures regulatory compliance and security policies are met, it fails to provide true omnichannel experiences.

- Rigid scalability makes it costly and time-consuming to adjust to changing requirements, remove communication and data silos and leverage new technology.

With the rapid pace of change in contact centre technology, greater focus has been placed on premises-to-cloud migration. In comparison, many fintech brands were built cloud native from the outset.

2. Lack of Digital Self-Services

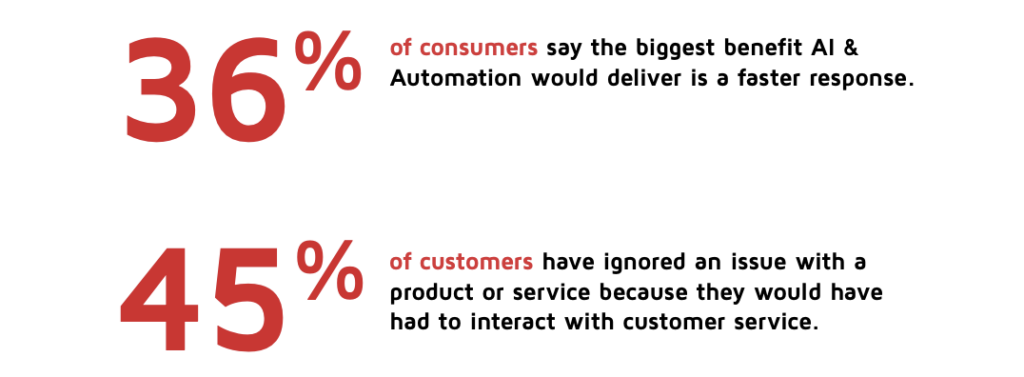

- Organisations that lack quality self-service functionality often burden their physical agents with routine and mundane tasks. While certain enquiries require human intervention, a significant and increasing number of questions can be efficiently handled through AI-powered self-service options.

- By implementing these solutions, companies can enhance their cost-to-income ratios, reduce agent workload and improve overall customer satisfaction.

Digital banks and lenders have recognised the shift to customer empowerment and self-service by embracing new technologies like generative AI.

3. The Inability To Deliver Seamless Omnichannel Experiences

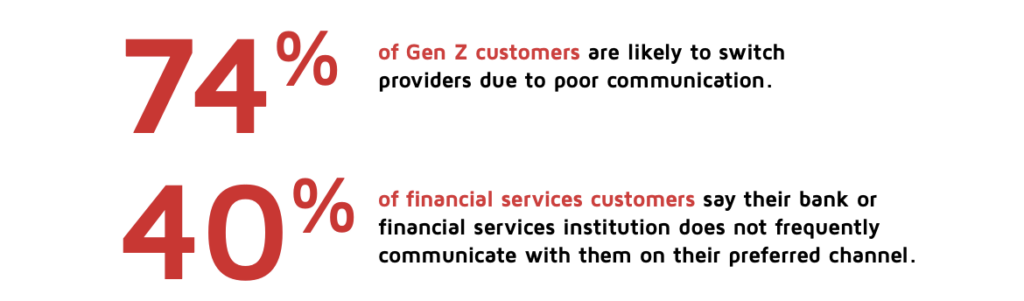

- With the proliferation of new channels and the expectation from customers to contact your company through their preferred method, delivering a seamless experience has never been more important.

- However, current channel capabilities frequently operate in complete isolation, with separate mobile apps, live chat, social, email and phone platforms.

Customers are often left with a fragmented experience that incurs repetition and delay. Newer providers and fintechs were engineered as omnichannel in their infancy.

4. Dormant Customer Data

- Siloed data lakes, integration challenges, strict regulations and a lack of advanced analytics tools reduce the ability to use customer data effectively.

- Lack of customer personalisation, inaccurate decision-making, missed sales opportunities and higher costs are all side effects of siloed data. Harnessing customer information enables improved customer experience, customer lifetime value and loyalty.

Because of their cloud foundations, many fintechs have had a head start and applied ML and AI models to their data to be able to achieve their market positions.

The transformation imperative to improve CX in financial services

Modern Challenges Require Modern Solutions

To be able to address the 4 key challenges outlined previously, the case for transformation is stronger than ever. Many contact centres still rely on outdated infrastructure, such as older IP-PBX systems or premises-based contact centre platforms.

These technologies struggle to integrate with modern customer relationship management (CRM) or unified communications systems, resulting in siloed communication channels, restricted self-service options, limited sharing of customer information and slow deployments of new capabilities.

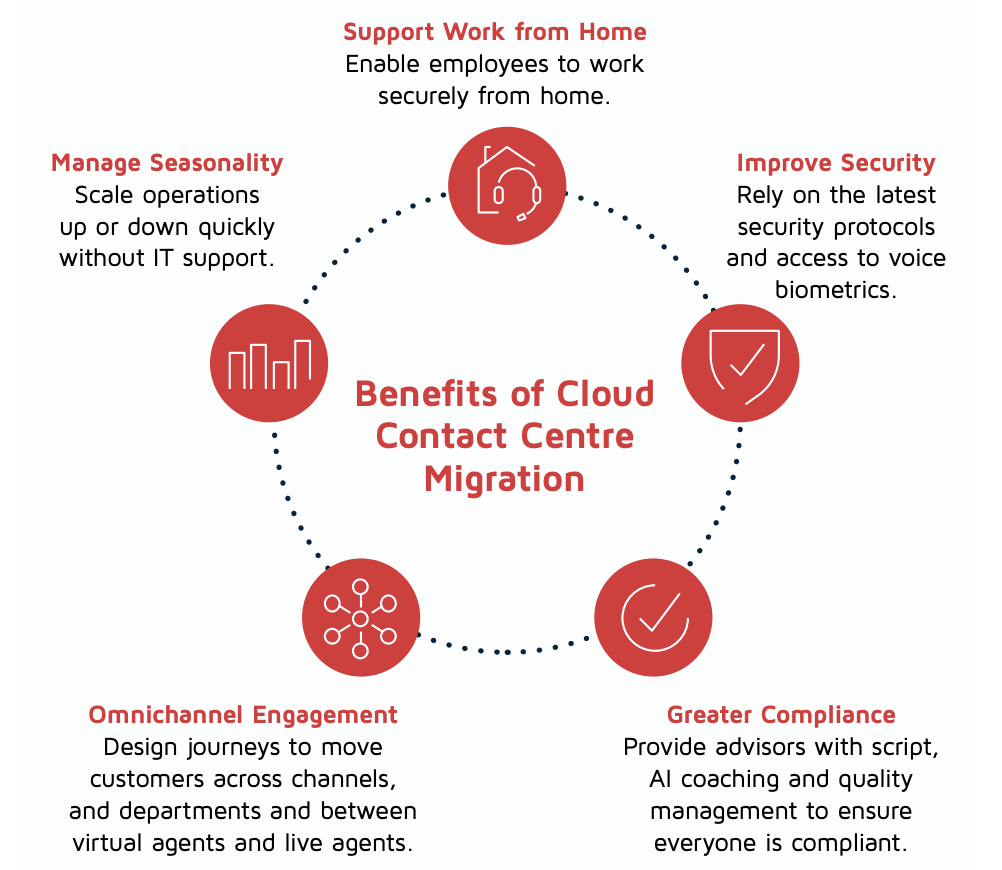

Cloud Migration Is Essential to Transformation

Transitioning from on-premises technology to the cloud enables greater flexibility in staff deployment as employees can securely work from home. Cloud-based systems also allow for seamless scalability in response to fluctuating demand, all while reducing infrastructure costs and maintenance requirements. Embracing the cloud not only enhances operational efficiency but also positions the business to adapt swiftly to industry changes.

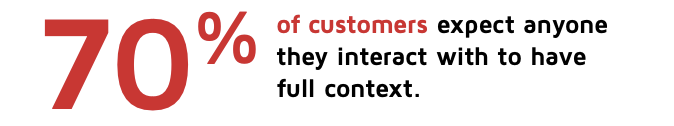

Transform for Journey Intelligence

Customers expect seamless experiences as they move across all channels, whether mobile, online, or in-person. Financial services must integrate these touchpoints to meet demands. By deploying a true omnichannel solution, customers can communicate with businesses safe in the knowledge that their information is retained and made available to the agent.

Transform to Enable AI-Powered Customer Self-Service

Customers increasingly prefer self-service for quick and efficient problem resolution. Investing in efficient self-serve technologies is an easy-win opportunity to improve the customer experience, all the while reducing the cost and burden on customer service agents.

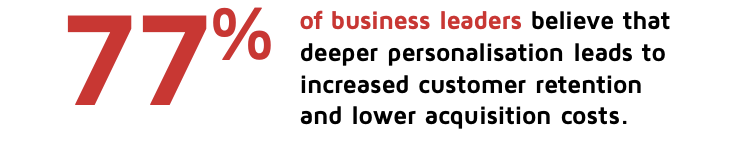

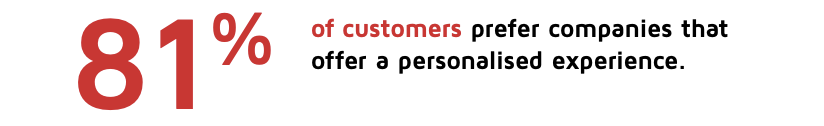

Transform for Experience Personalisation

Generative AI is making a notable change in how financial services can improve CX to leverage their vast amounts of consumer data. Today, businesses are using these tools to enrich all aspects of the customer experience to deliver hyper-personalised engagements that drive improved loyalty and satisfaction.

Unlocking the benefits of the cloud

The Drivers for Contact Centre Migration

The work from home phenomenon drove a need to rethink existing business IT infrastructure. On-premises environments quickly became restrictive, costly and slow to adapt when provisioning for remote working models. Overlay the explosion of large language models (LLMs) and generative AI tools, and the need to move to a more dynamic and flexible platform becomes more important.

With customers demanding superlative experiences and financial services organisations striving for productivity gains at lower costs, premises-based contact centre businesses must now consider the following drivers.

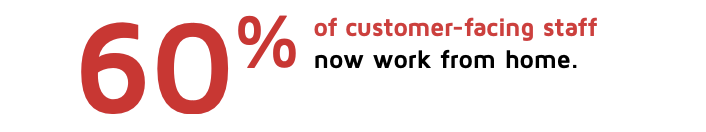

Limitations of Remote Working Impacts Business

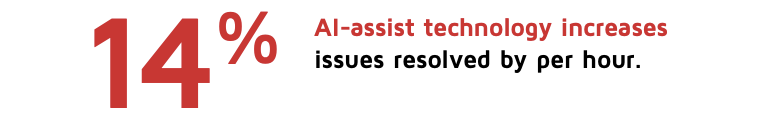

Cloud-enabled AI technology should be viewed as an accelerant to employee performance. Being able to deploy these tools at scale and speed can massively improve your employee experience and return productivity gains.

For example, let’s look at AI:

- Intelligent Virtual Agents (IVAs) save cost and alleviate human intervention for low value tasks.

- Agent assist technology reduces the cognitive load of agents, making their jobs easier.

- AI analytics improves supervisor productivity by focusing on areas of most concern.

Customers Increasingly Expect More

Cloud-based LLMs and generative AI advancements are powerful new tools that, if used correctly, will allow you to control data and risk management challenges. The upside is enormous.

You will unlock capabilities, including real-time transcriptions, next-best action suggestions that draw from proprietary data stores, and automated scoring that will surface new insights to agents, allowing them to provide a more personalised service.

Businesses Understand the Value of CX

As your customer-facing employees are increasingly empowered with more customer data through cloud integrations, they deliver more personalised service. End customers, in turn, feel understood and appreciated, increasing brand loyalty and generating repeat sales. This cycle accelerates as customers engage with you more frequently. It gives your AI applications more opportunity to deepen their understanding so that personalisation gets better over time, automatically.

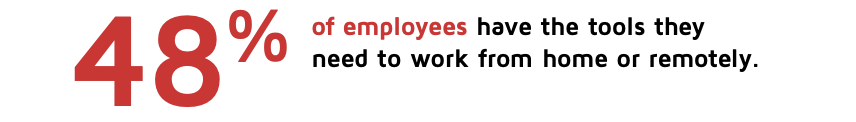

Intelligent Automation is Happening Everywhere

Cloud-based solutions enable lower IT operating costs and increase the ability to leverage existing investment while reducing the associated cost of new hires and training.

Cloud applications allow you to scale with no hardware or professional services requirements and can augment staff shortages to deliver faster, automated service to your customers.

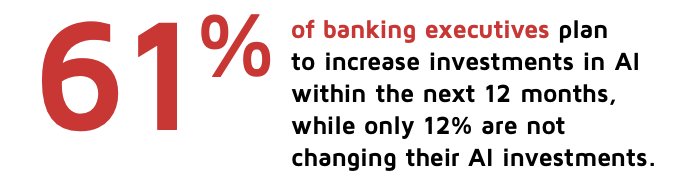

Enable customers through AI-powered self-service to improve CX

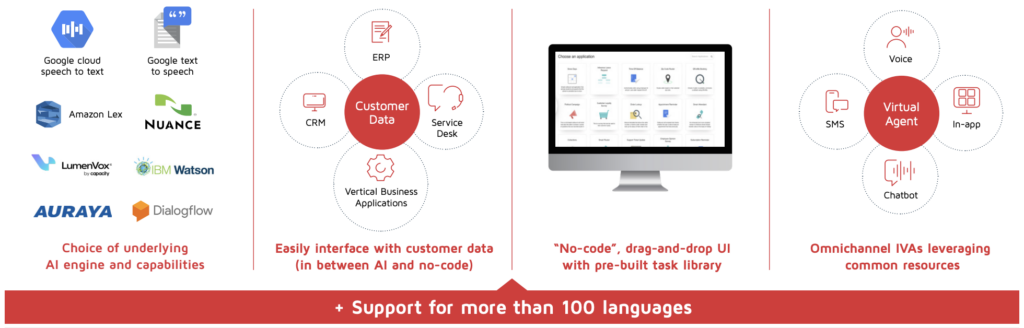

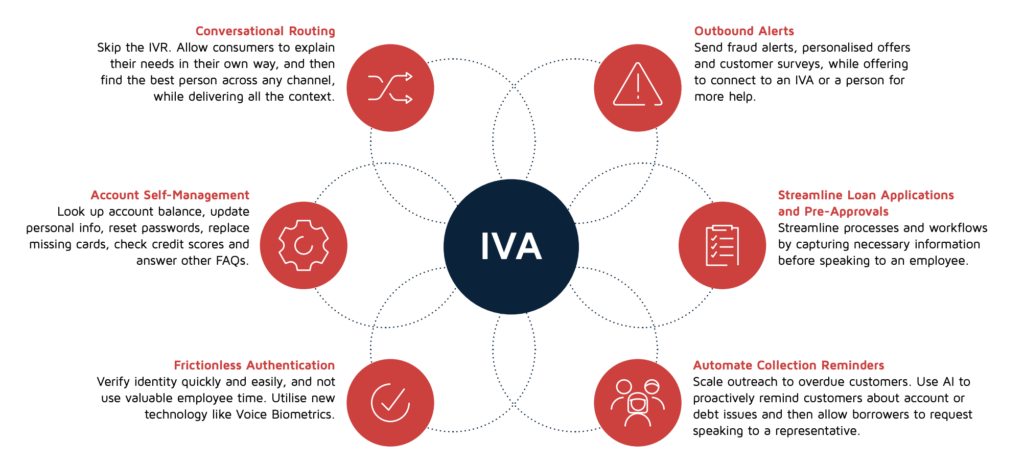

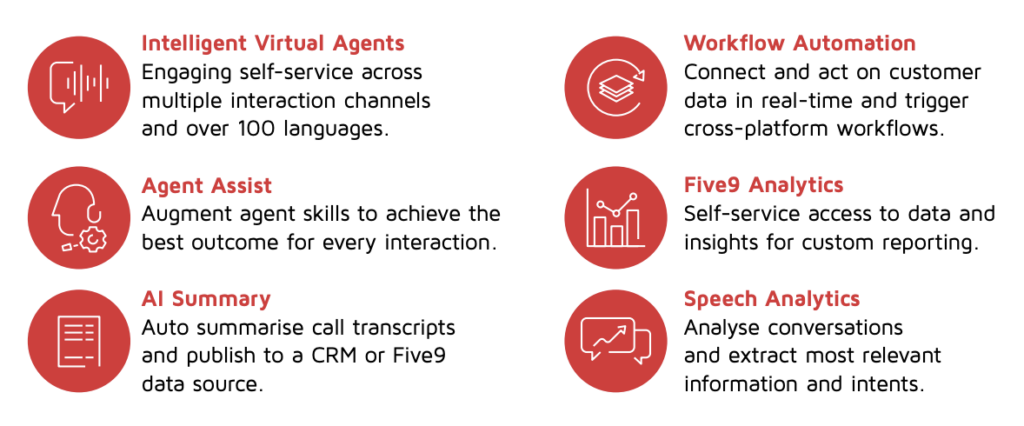

Intelligent Virtual Agents (IVAs) use artificial intelligence to provide personalised interactions in a conversational manner that can route customers, answer questions and take actions. These can be deployed via voice and digital channels to automate and streamline the customer experience whilst removing the need for human intervention.

What to Consider in an IVA Platform

IVAs can be used with both on-premises, hybrid, or cloud environments to remove the burden on your agents and to speed up issue resolution with your customers. Selecting a provider that is totally AI-agnostic means you can personalise your Intelligent Virtual Agent and future-proof them as your requirements evolve.

With access to an ecosystem of market-leading AI and speech services, and with the ability to switch between vendors at anytime, financial services organisations can rapidly scale their self-service capabilities. Using a single, no-code development platform, businesses can build, deploy and manage all their voice and digital IVAs from one place.

Benefits of using intelligent virtual agents to improve CX

Financial Services Organisations

- Deflects conversations from the contact centre while securely completing requests at a fraction of the cost of live agents.

- Extends operations 24x7x365 in multiple languages and across all channels.

- Enables operations to focus employees on more critical tasks.

- Pre-built task library and easy updates streamlines IVA management.

Live Agents

- Removes repetitive requests and mundane tasks from workload.

- Improves job satisfaction and reduces churn. • Frees up time for higher value tasks.

- Prepares employees with real-time insight into client requests before conversations begin.

Customer

- 24x7x365 availability with a personalised experience based on existing data.

- Provides a consistent self-service experience across all voice and digital channels.

- Improves first-time resolution rates and NPS scores.

- Reduces overall customer effort.

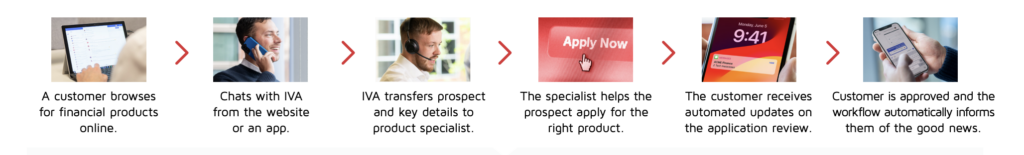

Build a better omnichannel solution to improve CX

As customers increasingly embrace digital financial services, organisations must extend and integrate customer support beyond brick-and-mortar branches to all available channels, including their website and mobile app.

With 73% of UK bank account holders using mobile banking, firms need to offer an omnichannel experience that matches the personalisation and support previously provided in-branch. Amid cost-cutting measures and a shift toward virtual customer service, how can financial services institutions achieve this transformation in customer experience?

Strategically design your AI solutions

Implementing AI technology into your business workflows can seem like a daunting task. How do you ensure that these tools deliver on their promise now and into the future?

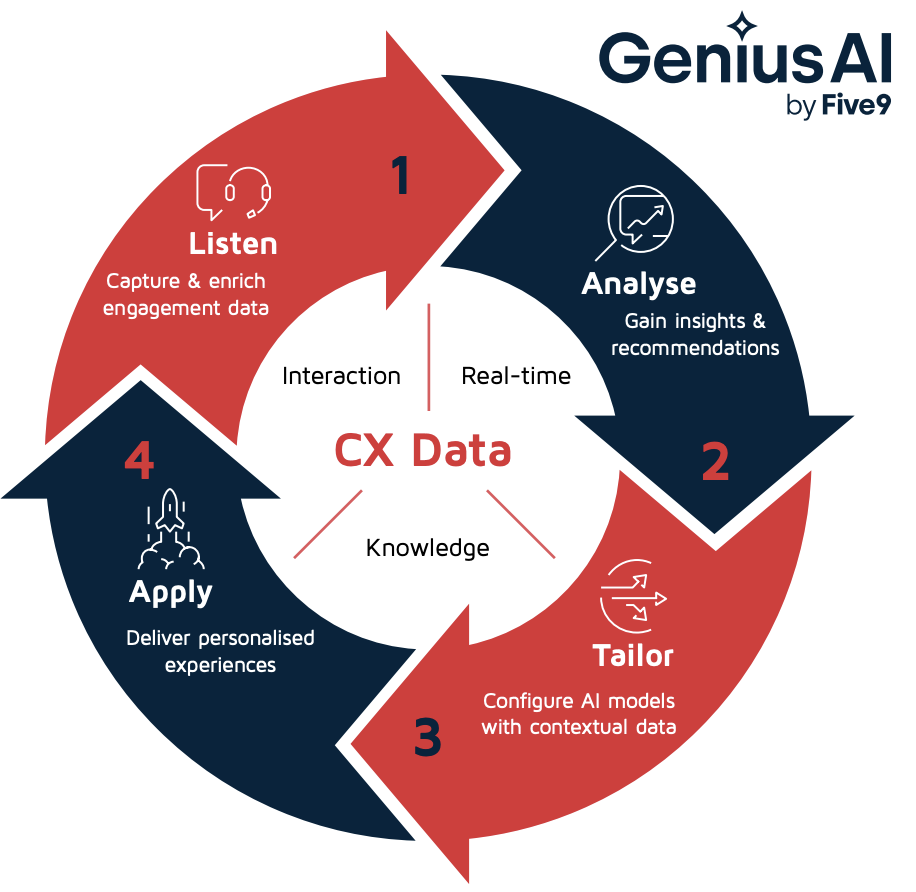

Five9 Genius AI is a comprehensive product suite that enables you to build AI applications tailored to your use cases. It is designed to deliver personalised self-service capabilities, automate workflows and work alongside your employees and agents to augment their abilities.

Five9 Genius AI harnesses the incredible potential of conversational and generative AI to offer AI-elevated CX. Leverage AI to optimise every touchpoint of the customer journey and improve experiences across the board for customers, agents, leaders and admins.

Core Features of the Five9 AI and Automation product suite:

- Delivers personalised and engaging self-service.

- Empowers agents, augmenting their abilities.

- Provides CX insights for business leaders.

- Provides a unified low-code/no-code intuitive interface to build a custom AI model.

Benefits of Five9 Genius AI

Opus and Five9: The right choice for businesses looking to improve CX in financial services

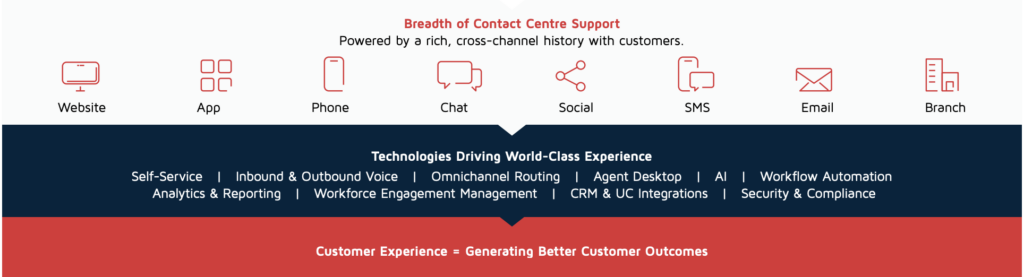

As the financial landscape evolves, it’s crucial for businesses to embrace digital transformation and leverage marketleading technologies like Five9’s contact centre services.

By transitioning to a cloud-based platform and utilising AI-driven tools, financial institutions can deliver seamless and personalised customer experiences, enriching every interaction with a unified view of customer data to enhance satisfaction and foster loyalty. With 20 years of global experience, Five9 offers an Intelligent CX Platform used by global and local banks, credit unions, lenders, wealth managers and insurers.

The highly scalable and secure Intelligent Cloud Contact Centre provides a comprehensive suite of applications for managing customer interactions across various channels. This cloud-native platform enables quick deployment and adjustment of agent seats in any location. It includes omnichannel engagement, Workforce Engagement Management, best-in-class AI-driven tools, and is supported by over 1,400 partners to enhance business outcomes for more than 2,500 organisations worldwide.

Opus are the no1. Five9 Partner in the EMEA. Get in touch to discover how we can transform your FinServe business with Five9 technology.

Download this useful guide now as a pdf

Within this handy guide we explore how FinServe businesses can fully embrace digital transformation and use innovation to drive results.